Friday, 15.12.2017, 08:00

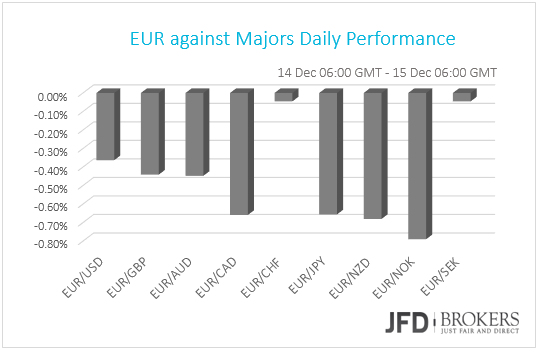

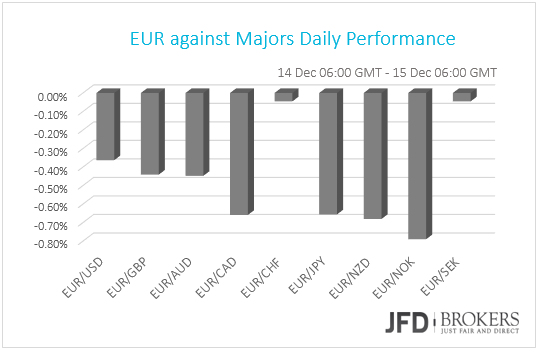

The Euro feels the heat of Draghi’s remarks

Yesterday, the ECB decided to keep policy unchanged as was widely expected. In the statement accompanying the decision, the bank repeated that asset purchases will continue until September 2018, or beyond if needed, and that the program can be extended or expanded if the outlook becomes less favorable. As for the economic projections, the Bank raised fairly its GDP estimates, and revised higher its inflation forecasts for 2018. Nevertheless, the first inflation estimate for 2020 was 1.7% yoy, which is less than the Bank’s target of below but close to 2%, and suggests that interest rates are likely to remain low for longer than previously anticipated.

The initial reaction in the common currency was positive, perhaps due to the GDP upgrades, but that was only temporary. The currency came under selling interest following Draghi’s remarks. In the Q&A session, the ECB Chief said that officials did not discuss cutting the link between QE and inflation. Remember that the minutes of the previous ECB gathering revealed that some policymakers wanted to set a clear end date to the QE program, meaning they may prefer to cut the inflation link. Draghi also made it clear that the “vast majority” of ECB wants an open-ended program, and that they never discussed a sudden stop to QE.

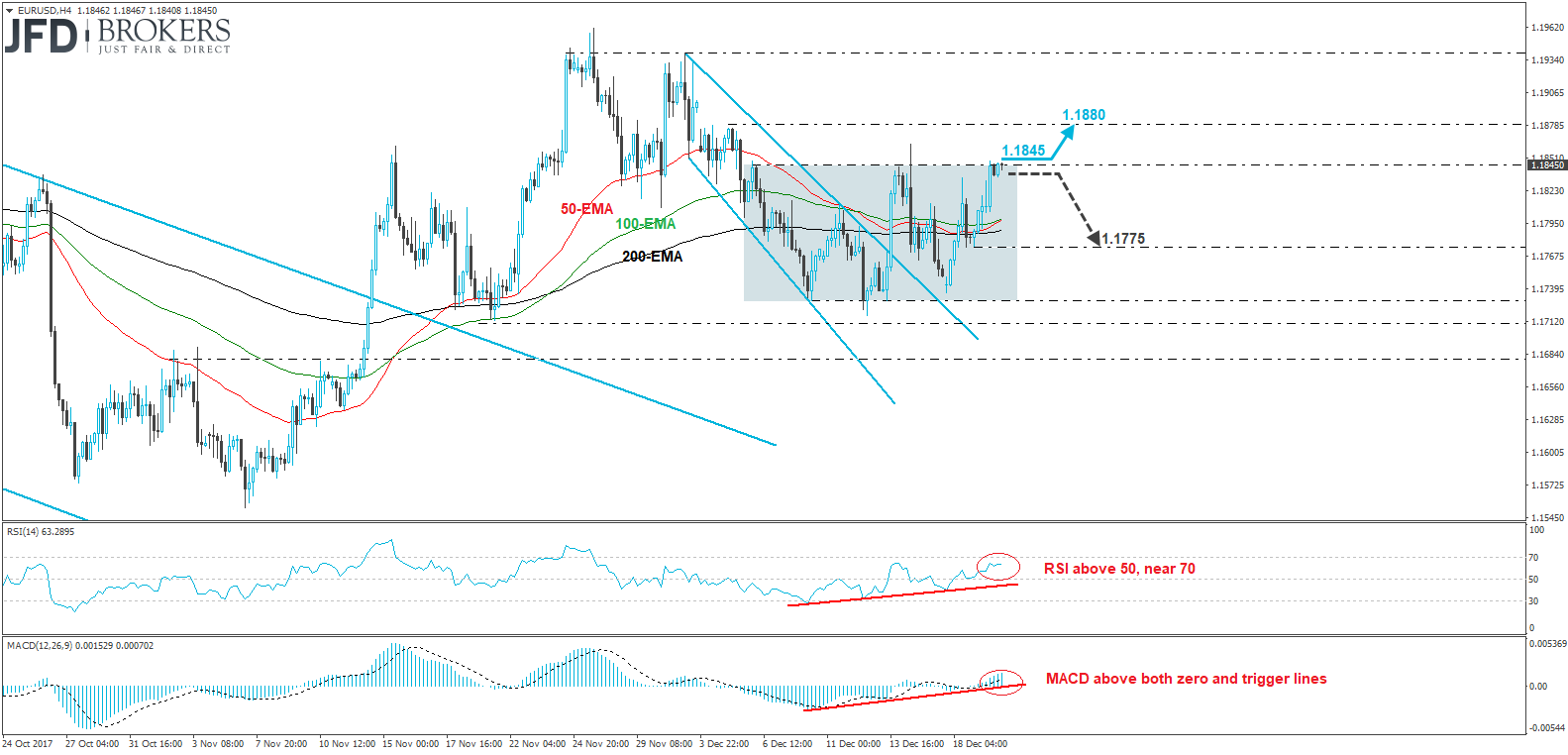

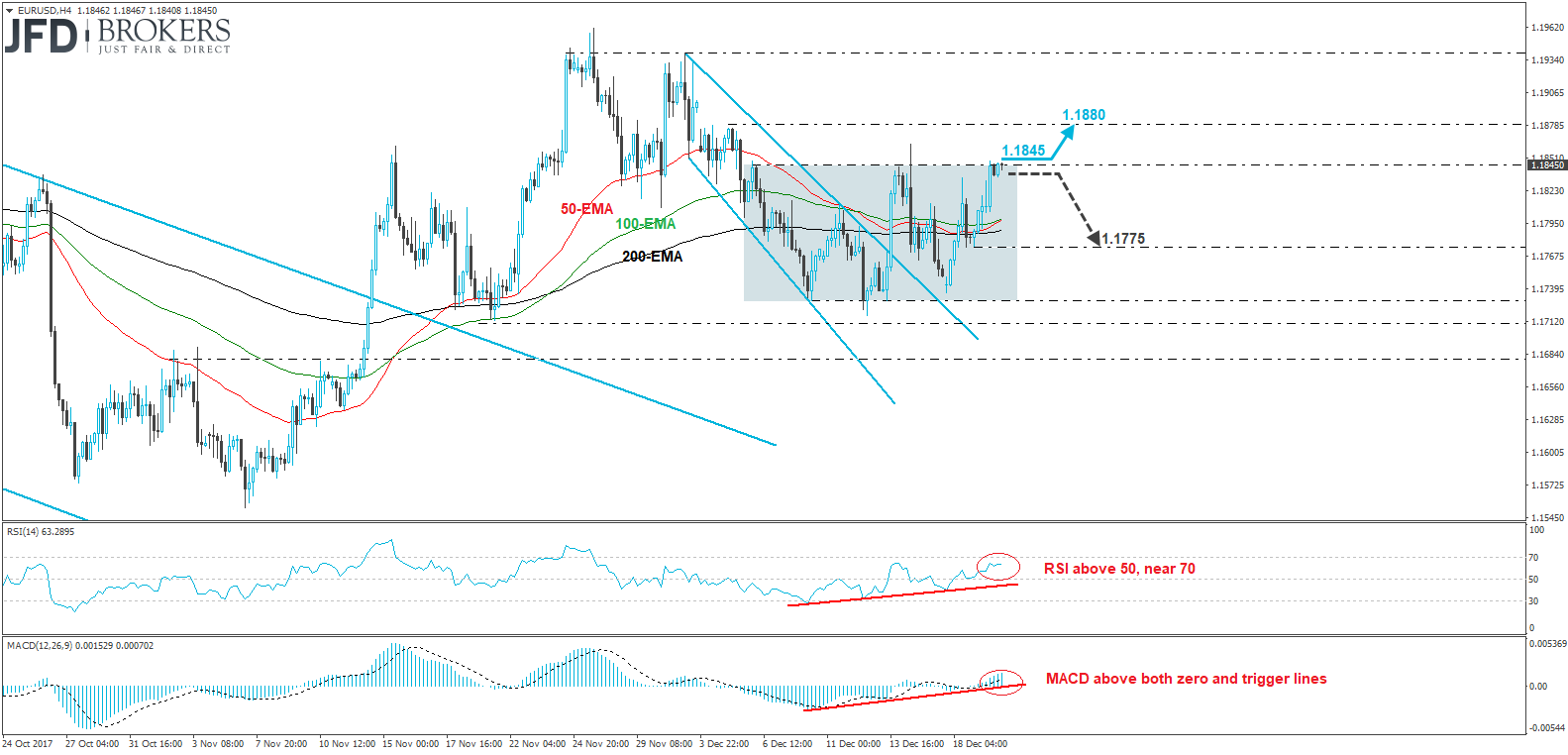

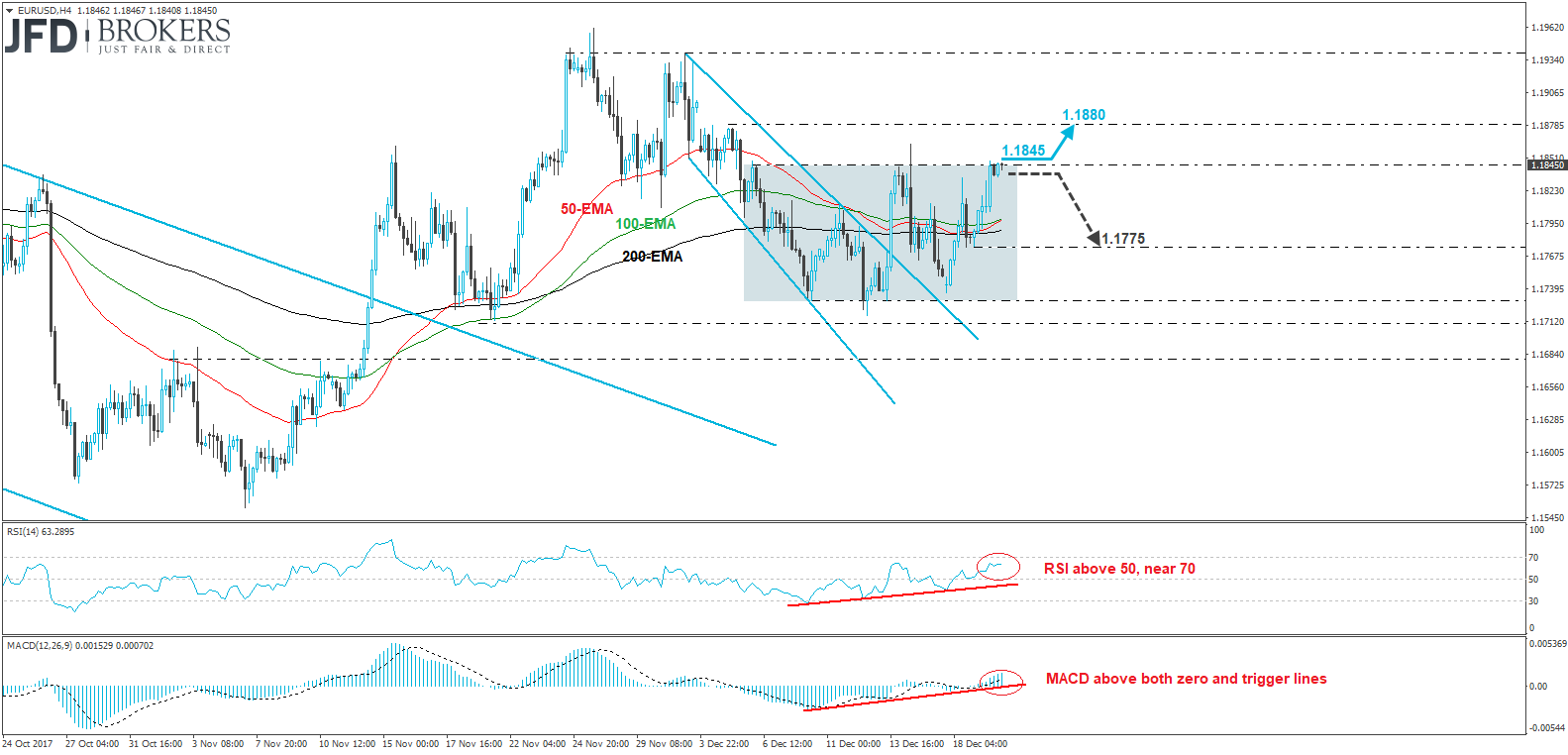

EUR/USD Technical Outlook

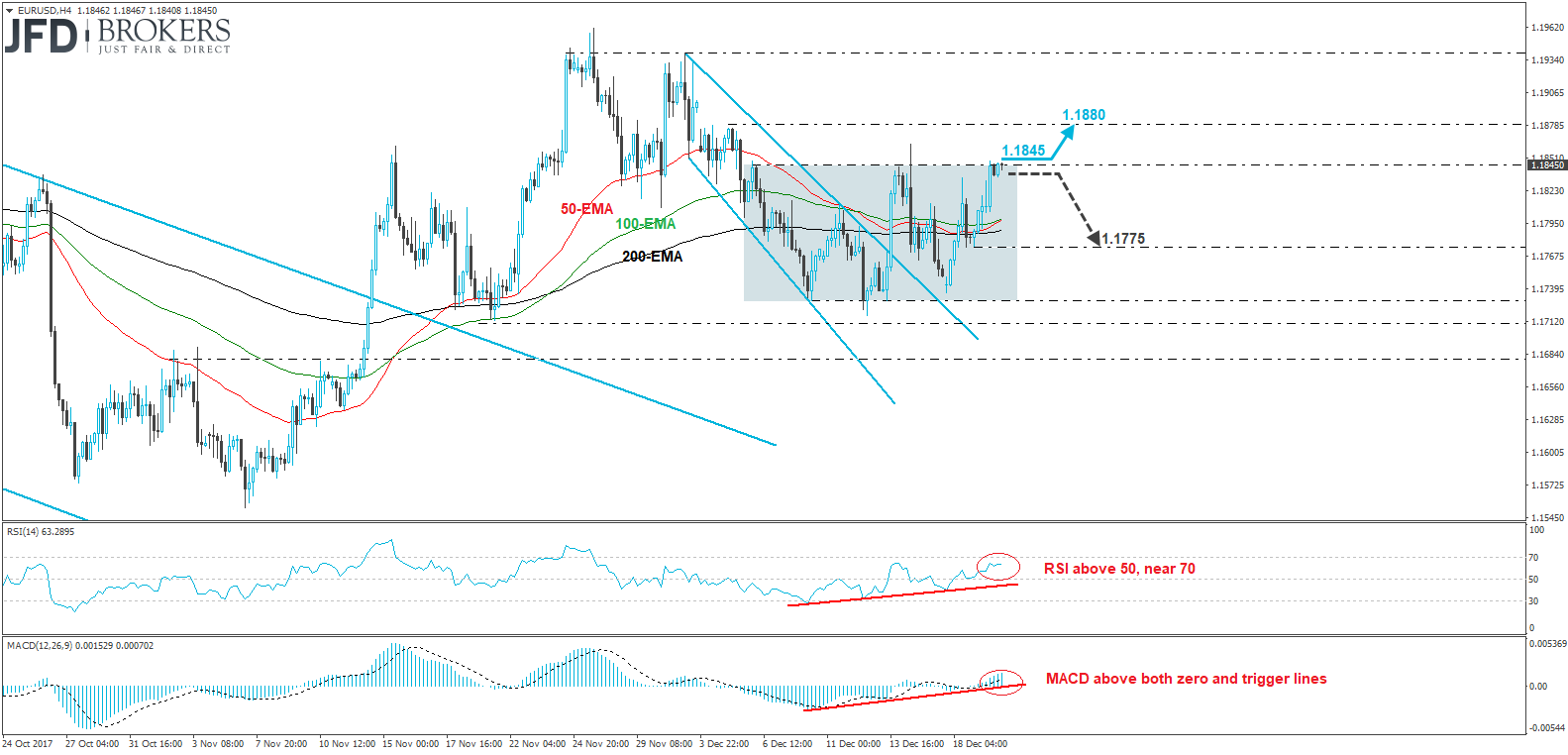

EUR/USD edged north following the ECB’s economic projections, but was quick to give back its gains and tumble even further following Draghi’s remarks. The pair fell below two support (now turned into resistance) lines in row to stop near the 1.1765 hurdle.

The pair continues to trade above the short-term downside line taken from the peak of the 1st of December, and thus we still believe that there is the likelihood for a rebound. Nevertheless, we prefer to wait for a clear break above 1.1810 before we get confident on that front. Such a break could see scope for extensions towards our next resistance of 1.1845. On the downside, a clear dip below 1.1765 could trigger more bearish extensions and perhaps challenge the 1.1730 support.

Both our short-term momentum studies lie near their equilibrium lines and point sideways, something that indicates indecision between EUR/USD traders to assume a direction, at least for now.

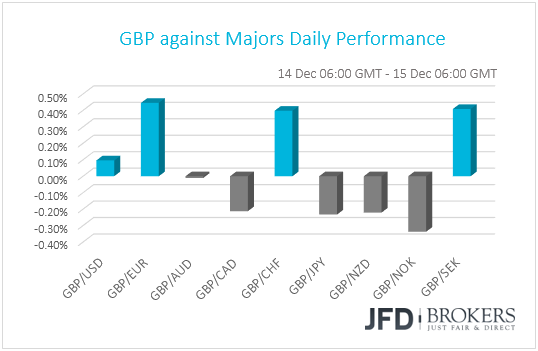

Sterling Reacts Little to the BoE Decision

Besides the ECB, the BoE had also to decide on policy yesterday. This Bank remained on hold as well, while there were very little deviations in language compared to the previous one. The initial reaction in Cable was approximately 35 pips to the downside, perhaps due to the absence of any hawkish hints. Speculation for a hawkish turn by the BoE may have been raised after inflation accelerated by 3.1%, which is more than 1 percentage points above the Bank’s target of 2%, and also fractionally above its own forecasts.

Focus for GBP traders now turns to the EU summit. Today is the day where the spotlight falls on Brexit. As we noted yesterday, we see the case for EU leaders to approve last Friday’s agreement and open the door for the second phase. Although this could be positive news for the pound, we remain skeptical on the currency’s performance in the months to come. Phase 2 includes the hot topic of trade, while the defeat of Theresa May in Parliament makes things even more complicated. The Parliament has now the power to either approve or reject any deal reached between EU and UK negotiators.

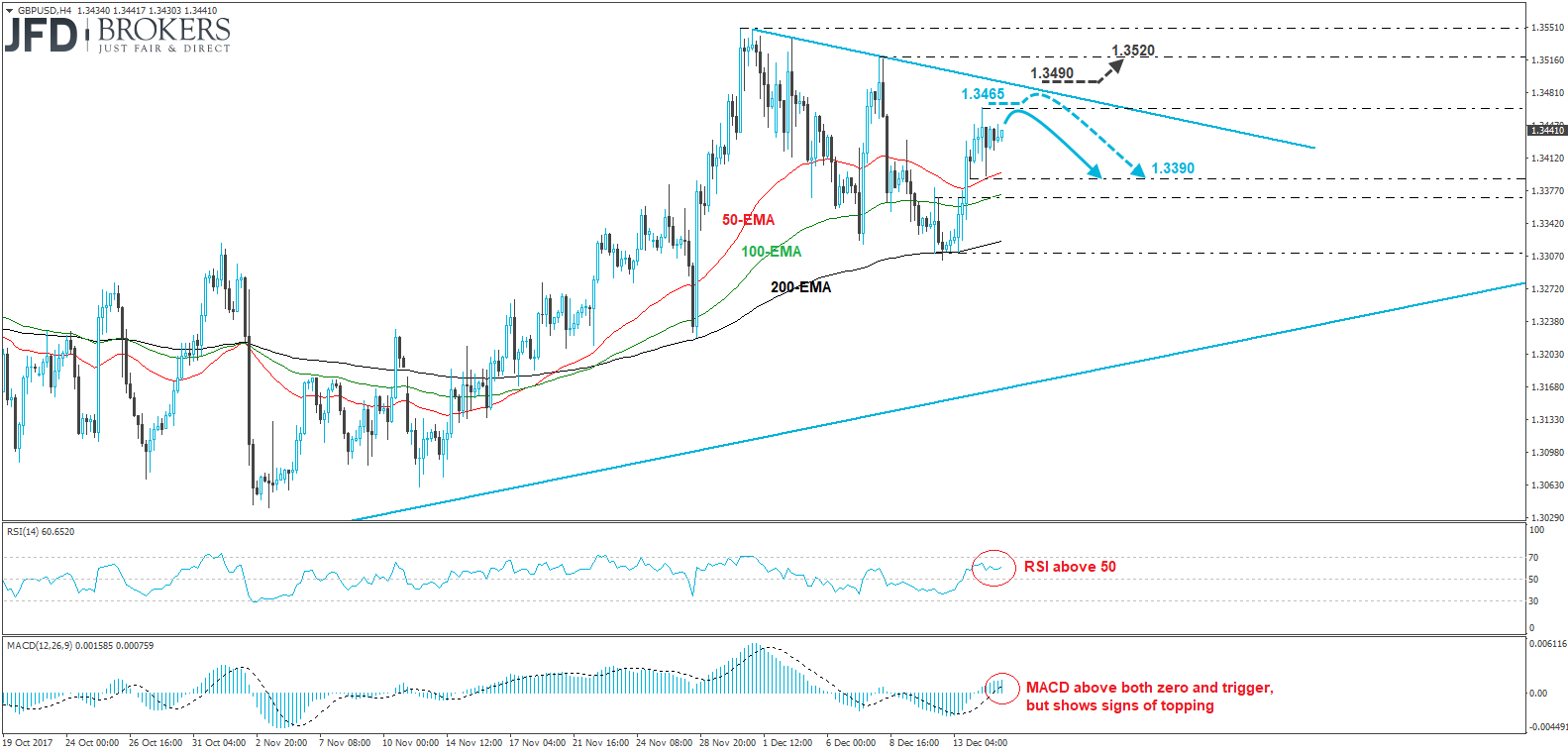

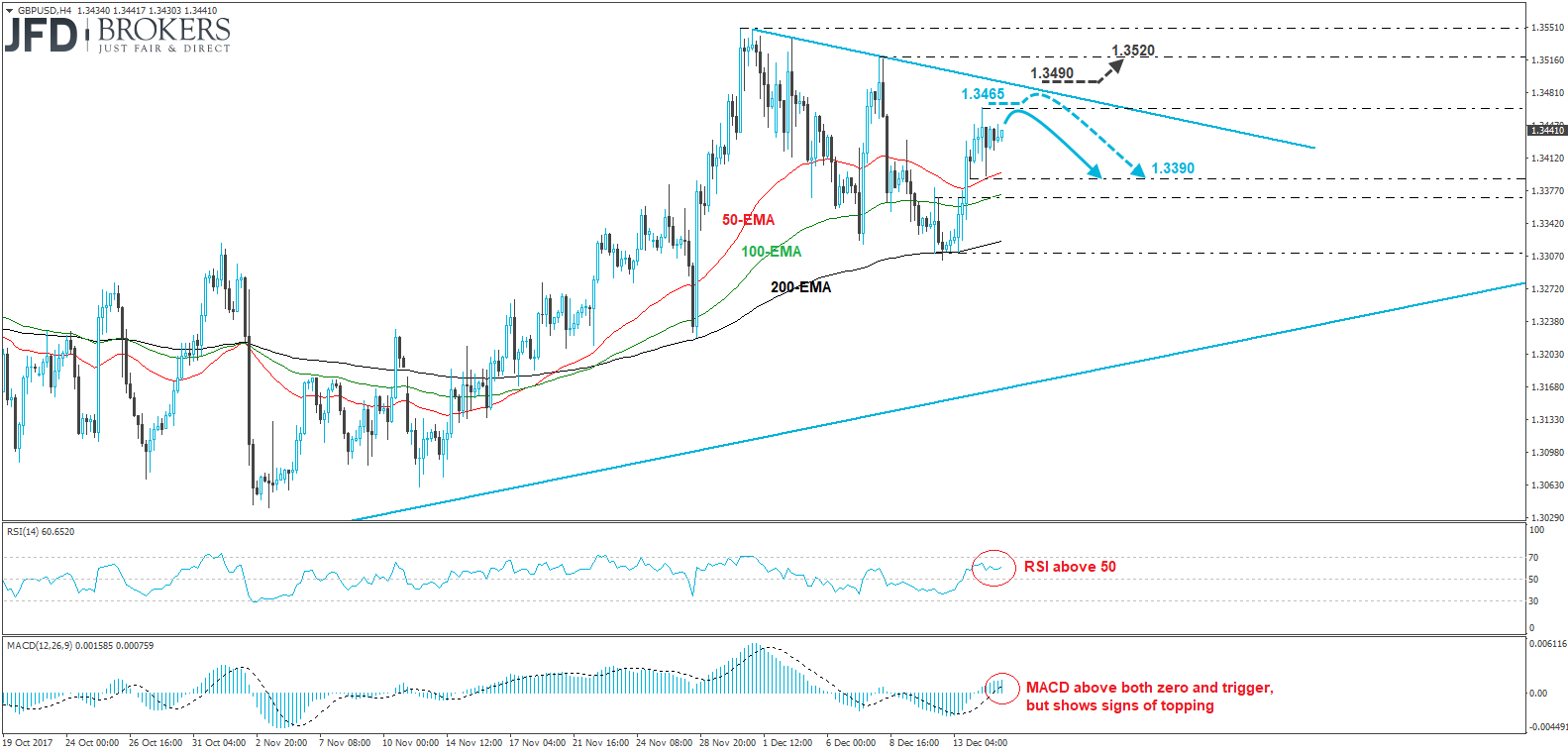

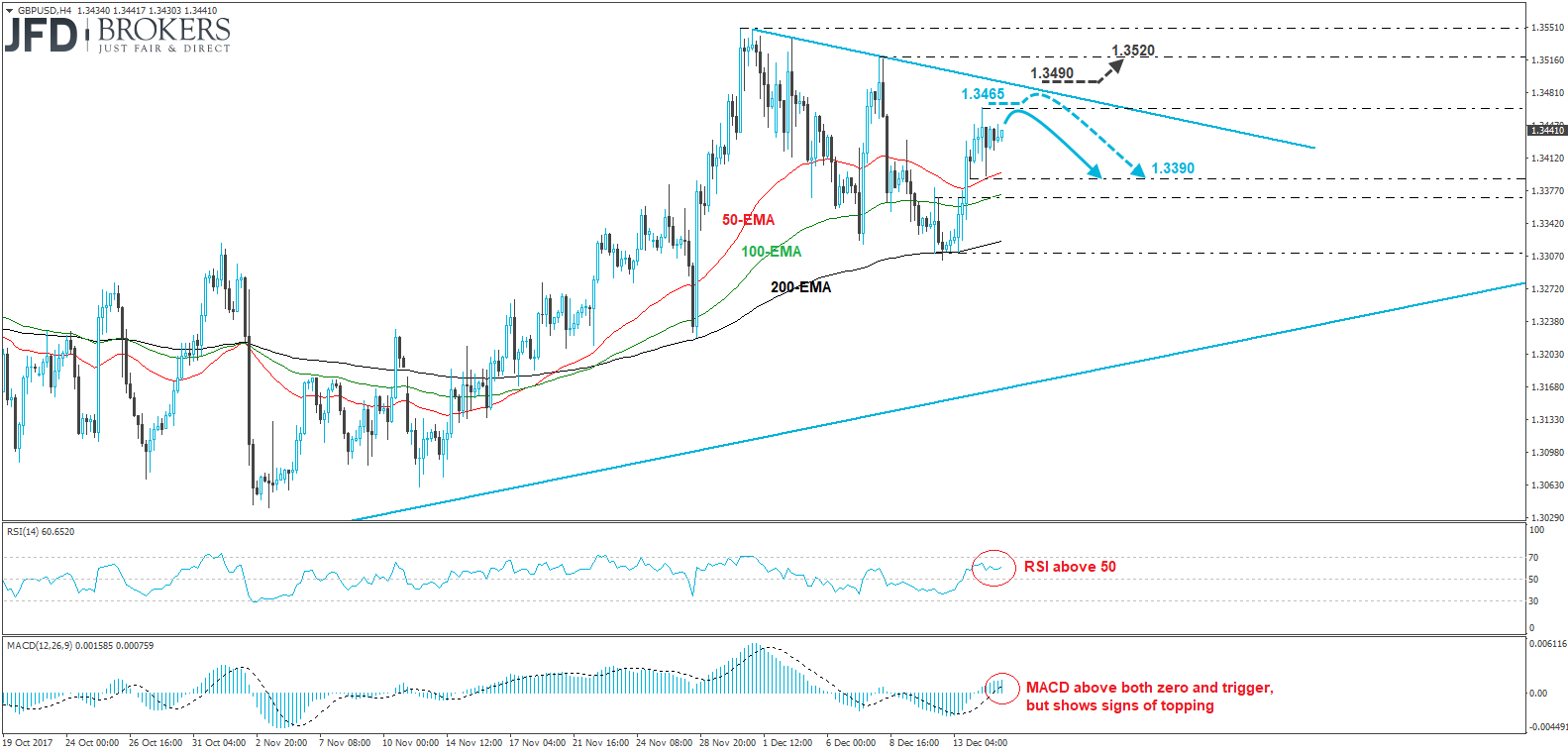

GBP/USD Technical Outlook

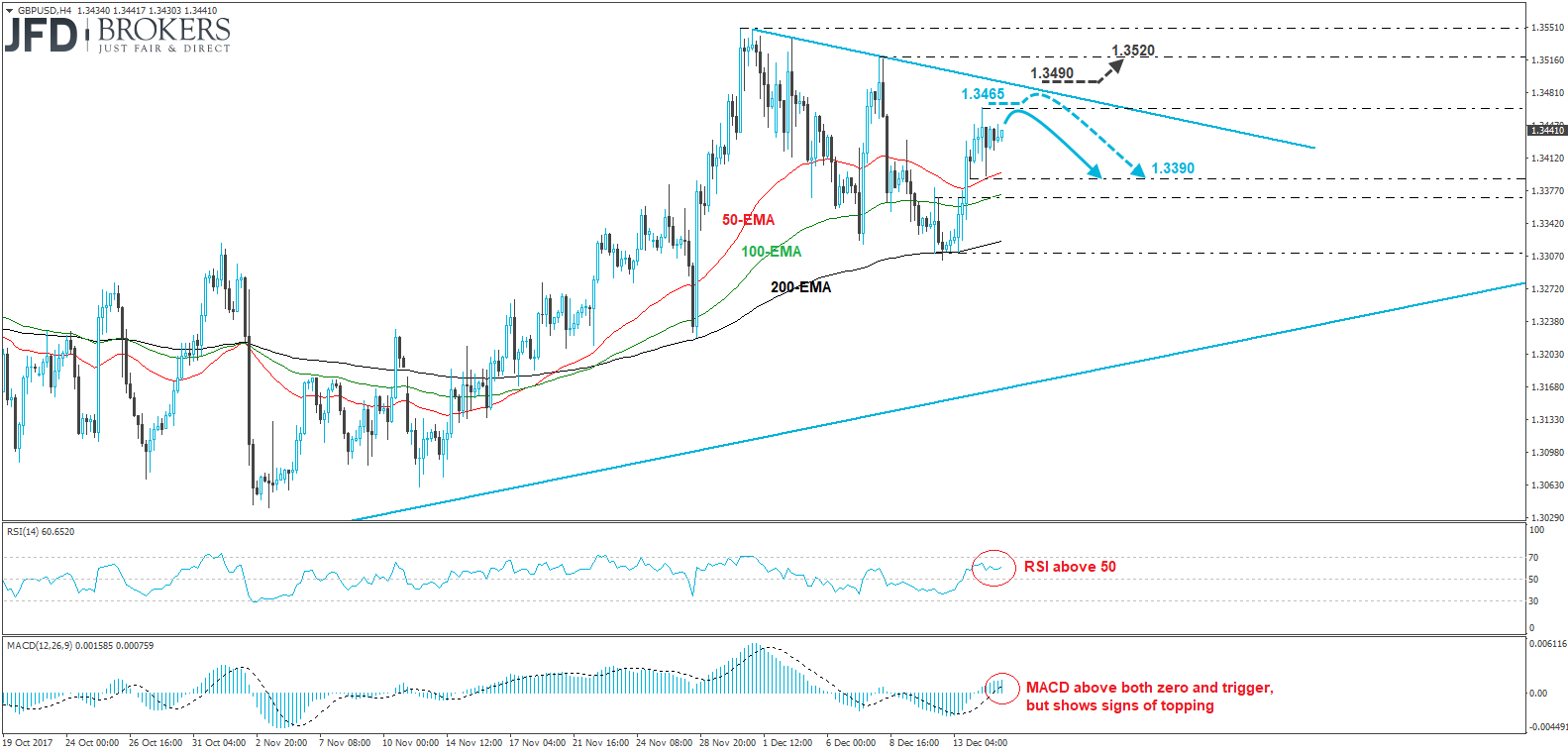

GBP/USD traded somewhat lower following the BoE decision, but was quick to recover. Actually, it ended the day within the green. Although it could trade a bit higher today if EU leaders approve last Friday’s agreement, we see the case for the rate to hit resistance near 1.3465 or the downside resistance line drawn from the peak of the 1st of December, and then to retreat again, perhaps for another test near the 1.3390 support zone.

Looking at our short-term momentum studies, we see that the RSI, already above 50, has turned up again. However, the MACD has started showing signs of topping, which supports somewhat the case that any further upside may be limited for now.

As for the Rest of Today’s Events

During the European morning, Eurozone’s trade surplus for October is forecast to have increased slightly.

In the UK, the BoE releases its Quarterly Bulleting. This could give us more information with regards to the Bank’s view on the economy, but given that all eyes will probably be on the EU summit today, we don’t expect this report to prove a major market mover.

Later in the US, the NY Empire State Manufacturing Index for December is coming out and expectations are for a small decline. The nation’s industrial production for November is also due to be released and the forecast is for a slowdown to +0.3% mom from +0.9% mom previously.

We have one speaker on today’s agenda: BoE MPC member and Chief Economist A

EUR/USD Technical Outlook

EUR Falls on Dovish ECB, GBP Reacts Little on the BoE; Now Focus Turns to EU Summit

Written by Charalambos Pissouros

Published in

Daily Market Report

Both the ECB and the BoE have fulfilled their monetary policy

obligations for 2017. Draghi played down any speculation about a QE end

date, while the BoE refrained from turning hawkish, despite inflation

accelerating to 3.1% yoy. Market participants now turn their eyes to the

EU summit.

The Euro feels the heat of Draghi’s remarks

Yesterday, the ECB decided to keep policy unchanged as was widely expected. In the statement accompanying the decision, the bank repeated that asset purchases will continue until September 2018, or beyond if needed, and that the program can be extended or expanded if the outlook becomes less favorable. As for the economic projections, the Bank raised fairly its GDP estimates, and revised higher its inflation forecasts for 2018. Nevertheless, the first inflation estimate for 2020 was 1.7% yoy, which is less than the Bank’s target of below but close to 2%, and suggests that interest rates are likely to remain low for longer than previously anticipated.

The initial reaction in the common currency was positive, perhaps due to the GDP upgrades, but that was only temporary. The currency came under selling interest following Draghi’s remarks. In the Q&A session, the ECB Chief said that officials did not discuss cutting the link between QE and inflation. Remember that the minutes of the previous ECB gathering revealed that some policymakers wanted to set a clear end date to the QE program, meaning they may prefer to cut the inflation link. Draghi also made it clear that the “vast majority” of ECB wants an open-ended program, and that they never discussed a sudden stop to QE.

EUR/USD Technical Outlook

EUR/USD edged north following the ECB’s economic projections, but was quick to give back its gains and tumble even further following Draghi’s remarks. The pair fell below two support (now turned into resistance) lines in row to stop near the 1.1765 hurdle.

The pair continues to trade above the short-term downside line taken from the peak of the 1st of December, and thus we still believe that there is the likelihood for a rebound. Nevertheless, we prefer to wait for a clear break above 1.1810 before we get confident on that front. Such a break could see scope for extensions towards our next resistance of 1.1845. On the downside, a clear dip below 1.1765 could trigger more bearish extensions and perhaps challenge the 1.1730 support.

Both our short-term momentum studies lie near their equilibrium lines and point sideways, something that indicates indecision between EUR/USD traders to assume a direction, at least for now.

Sterling Reacts Little to the BoE Decision

Besides the ECB, the BoE had also to decide on policy yesterday. This Bank remained on hold as well, while there were very little deviations in language compared to the previous one. The initial reaction in Cable was approximately 35 pips to the downside, perhaps due to the absence of any hawkish hints. Speculation for a hawkish turn by the BoE may have been raised after inflation accelerated by 3.1%, which is more than 1 percentage points above the Bank’s target of 2%, and also fractionally above its own forecasts.

Focus for GBP traders now turns to the EU summit. Today is the day where the spotlight falls on Brexit. As we noted yesterday, we see the case for EU leaders to approve last Friday’s agreement and open the door for the second phase. Although this could be positive news for the pound, we remain skeptical on the currency’s performance in the months to come. Phase 2 includes the hot topic of trade, while the defeat of Theresa May in Parliament makes things even more complicated. The Parliament has now the power to either approve or reject any deal reached between EU and UK negotiators.

GBP/USD Technical Outlook

GBP/USD traded somewhat lower following the BoE decision, but was quick to recover. Actually, it ended the day within the green. Although it could trade a bit higher today if EU leaders approve last Friday’s agreement, we see the case for the rate to hit resistance near 1.3465 or the downside resistance line drawn from the peak of the 1st of December, and then to retreat again, perhaps for another test near the 1.3390 support zone.

Looking at our short-term momentum studies, we see that the RSI, already above 50, has turned up again. However, the MACD has started showing signs of topping, which supports somewhat the case that any further upside may be limited for now.

As for the Rest of Today’s Events

During the European morning, Eurozone’s trade surplus for October is forecast to have increased slightly.

In the UK, the BoE releases its Quarterly Bulleting. This could give us more information with regards to the Bank’s view on the economy, but given that all eyes will probably be on the EU summit today, we don’t expect this report to prove a major market mover.

Later in the US, the NY Empire State Manufacturing Index for December is coming out and expectations are for a small decline. The nation’s industrial production for November is also due to be released and the forecast is for a slowdown to +0.3% mom from +0.9% mom previously.

We have one speaker on today’s agenda: BoE MPC member and Chief Economist A

EUR/USD Technical Outlook

The influx of fake broker agencies(companies ) into forex trading has scared many from trading because of the fear of loosing their money. While this maybe justified, they are also missing out on the opportunities that abound with forex trading. I will only advice that traders ensure that their broker agency(company) is regulated before investment. They should invest only an amount they can afford to loose. Eventually, you can also consult the service of this recovery expert, if you want to recover your lost funds or learn about present situations in the market,

ReplyDeletecontact( Dejaellie@gmail.com)

Or whatsapp +1205-708-0398

no payment is required,

nor deposits

She has helped a lot of people including me

Hello everyone, Are you into trading or just wish to give it a try, please becareful on the platform you choose to invest on and the manager you choose to manage your account because that’s where failure starts from be wise. After reading so much comment i had to give trading tips a try, I have to come to the conclusion that binary options pays massively but the masses has refused to show us the right way to earn That’s why I have to give trading tips the accolades because they have been so helpful to traders . For a free masterclass strategy kindly contact (paytondyian699@gmail.com) for a free masterclass strategy. He'll give you a free tutors on how you can earn and recover your losses in trading for free..or Whatsapp +1 562 384 7738

ReplyDelete