Four Simple Ways to Become a Better Price Action Trader

Oct 5, 2013 12:58 am +06:00

Article Summary:

‘Price Action is my favorite indicator, because it’s the only one that will never tell me a lie.’

And this is true; albeit maybe a little ‘opaque’ for new traders,

or even experienced traders that haven’t yet found the study of price

action. The study of price action entails reading past prices, to build an approach or plan for the future.

Surely, most traders that end up ‘making it’ as a trader will find this specific study of technical analysis eventually; but it’s usually only after multiple disappointments and failed attempts at building indicator-based strategies that zig when the market actually ‘zags.’ So, please allow me to elaborate on my earlier statement.

Price action will never lie to us, as traders, because it never purports to tell us what WILL happen; but rather it only tells us what HAS happened.

There is a chasm of disconnect between these two premises.

As a trader, you will NEVER truly know what will happen in the future. Any indicator or indication of what MAY happen in the future is just a possibility. And even then, it could be a remote possibility at best because that indicator you’re using - well, it’s really just a fancy way of looking at previous price action.

So, regardless of the strategy - those same boring concepts of risk, trade, and money management are of the upmost importance to the trader.

But after that - traders can focus on getting the probabilities on their side as much as possible through analysis, and this is where price action can really shine.

Because, once again - this is a ‘clean’ way of looking at past prices, without the obfuscation of a mathematical formula that may be obscuring what’s happened in the recent past.

Below are four simple ways that traders can become better at reading, reacting, and analyzing price action.

Method 1 - The Price Action Primer

If you’ve been to DailyFX over the past couple of years, you may have encountered a previous article on price action. We talk about this A LOT because of all the aforementioned reasons, and quite simply - it works. Not that it works in telling us the future, but it works in allowing us to see the past as efficiently and honestly as possible.

Method 2: Grade Trends by Focusing on Swings

One of the first pillars of technical analysis centers on that age-old saying of ‘the trend is your friend.’

And the reason for this goes right back to one of those very first things we touched on at the beginning of this article: The future really is unpredictable.

But trends take place for reasons, right? Maybe it was a QE announcement, or a Debt Crisis - whatever the reason, trends exist much like the tide of the ocean exists.

And just like swimmers in the ocean, traders are often best served by going with the flow.

Because, if we look at trading as pessimistically as we can, and we assume that any individual trade is akin to flipping a coin, then we have a 50/50 chance of price moving up or down, right?

Well, if that bias continues, and further - if we are trading in the direction of that bias, it stands to reason that we can begin moving our chances or probabilities of success slightly better than a 50/50 split.

Perhaps it’s small, perhaps as small as 51/49 in our favor, or 52/48 - but the logic is the same.

If what has happened continues happening, I may stand a better-than-fair chance at success.

If we add in strong money management, well - now we have an entire strategy!

Traders can read and gauge trends using solely price action. We expand on this topic in our Introduction to Price Action; but we can simply look to the chart to point out the trend.

Up-trends will often be highlighted with higher-highs, and lower-lows

Image taken from Price Action, an Introduction

Image taken from Price Action, an Introduction

Meanwhile, down-trends will see lower-lows, and lower-highs

Image taken from Price Action, an Introduction

Image taken from Price Action, an Introduction

And this, in-and-of-itself, is very powerful... but the big question you need to ask yourself is whether it is enough to just simply ‘buy’ when prices have been moving higher, or to ‘sell’ when prices have been moving lower?

The answer is a definitive ‘no.’ And the reason is because, once again, we want to try to get the best possible chances of success in the market given the information available to us, and for that we can move on to the next method.

Method 3: Use Price Action to Highlight Valuable Support and Resistance

The second primary aspect of technical analysis is Support and Resistance, and this is another message that the study of prices can bring to us.

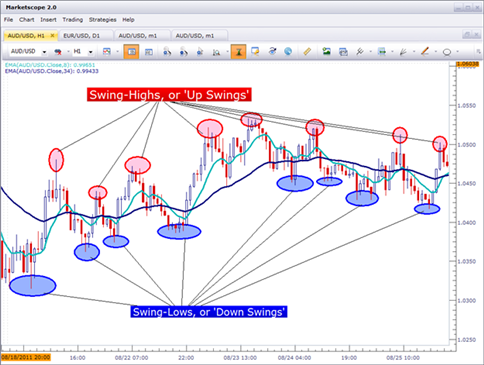

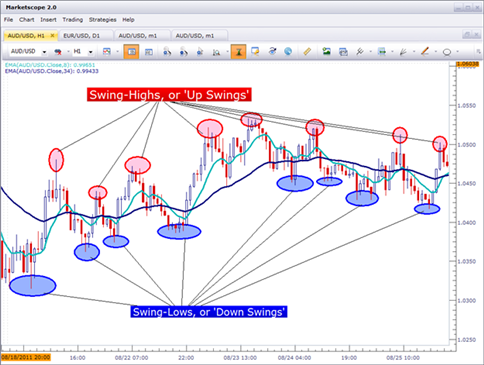

Price Swings can identify support and resistance in the market

Image taken from Price Action Swings

Image taken from Price Action Swings

Reading ‘swings’ in the market is an easy way to begin doing this. A swing can, quite simply, be classified as an inflection point in the market. We discussed this topic in the article Price Action Swings, and have added an illustration below to highlight this point.

The swing in the market is the point at which demand outstripped supply (in the case of a swing low setting support), or supply ran over demand (creating a swing high of resistance before prices moved lower).

Traders can use these progressively higher swing-highs, and higher swing-lows to define an up-trend. Each of these swing-highs offering a point of support with which traders may be able to look to buy into the up-trend ‘cheaply.’

Higher swing-lows define support in an up-trend

Image taken from Price Action Swings

Image taken from Price Action Swings

They can also use progressively lower-lows, and lower-highs to denominate a down-trend. And, of course, each of these lower ‘swing-highs’ become levels of resistance that traders can use.

Lower swing-highs define resistance in a down-trend

Image taken from Price Action Swings

Image taken from Price Action Swings

We can even rope in some additional Support and Resistance studies in an attempt to find really important levels. Psychological levels, for instance, can be a great way of pointing out swings that might have a little more importance in the market place. Fibonacci can be another fantastic addition to Price Action to point out levels that other traders may be watching for.

After traders can identify swings with support and resistance inflections, traders can then begin looking to buy up-trends cheaply, at or near support; while traders can look to sell expensively when prices are at or near resistance. Which brings us to the exact entry of the trade…

Method 4: Use Price Action Formations to Trigger into Positions

After the trend has been identified, and after traders have found support and resistance via swings displayed in the marketplace, traders can begin looking for formations to decide when, and how to enter into positions.

There are quite a few of these out there, and we’ve talked about numerous such formations over the past few years. Most recently, we highlighted five of the most common bearish reversal patterns in the article, Trading Bearish Reversals.

A Bearish Engulfing Pattern before a massive move lower

Image taken from Trading Bearish Reversals

Image taken from Trading Bearish Reversals

We also published this piece specifically on the hammer and inverted hammer formations.

Image taken from The Hammer Trigger for Bullish Reversals

Image taken from The Hammer Trigger for Bullish Reversals

And, a favorite of price action traders, the pin bar can offer some excellent entry opportunities.

To learn more:

I know that when I was learning price action, much of it, at least initially, felt very esoteric. So, in our constant effort to provide the best possible education for our traders, we offer numerous price-action based webinars every single week.

I do a webinar on DailyFX each week. During this webinar, I’ll look at various markets to show how traders can integrate this type of knowledge in a dynamic environment, and further - how to strategize with and around it.

-- Written by James Stanley

James is available on Twitter @JStanleyFX

To join James Stanley’s distribution list, please click here.

- Price Action is a form of technical analysis that focuses solely on past prices that have traded in the market

- This article contains a simple, and complex method for new traders to begin learning price action

- This study can be furthered in the live sessions on DailyFX in which Analysts and Instructors explain price action in real market conditions

‘Price Action is my favorite indicator, because it’s the only one that will never tell me a lie.’

Surely, most traders that end up ‘making it’ as a trader will find this specific study of technical analysis eventually; but it’s usually only after multiple disappointments and failed attempts at building indicator-based strategies that zig when the market actually ‘zags.’ So, please allow me to elaborate on my earlier statement.

Price action will never lie to us, as traders, because it never purports to tell us what WILL happen; but rather it only tells us what HAS happened.

There is a chasm of disconnect between these two premises.

As a trader, you will NEVER truly know what will happen in the future. Any indicator or indication of what MAY happen in the future is just a possibility. And even then, it could be a remote possibility at best because that indicator you’re using - well, it’s really just a fancy way of looking at previous price action.

So, regardless of the strategy - those same boring concepts of risk, trade, and money management are of the upmost importance to the trader.

But after that - traders can focus on getting the probabilities on their side as much as possible through analysis, and this is where price action can really shine.

Because, once again - this is a ‘clean’ way of looking at past prices, without the obfuscation of a mathematical formula that may be obscuring what’s happened in the recent past.

Below are four simple ways that traders can become better at reading, reacting, and analyzing price action.

Method 1 - The Price Action Primer

If you’ve been to DailyFX over the past couple of years, you may have encountered a previous article on price action. We talk about this A LOT because of all the aforementioned reasons, and quite simply - it works. Not that it works in telling us the future, but it works in allowing us to see the past as efficiently and honestly as possible.

Method 2: Grade Trends by Focusing on Swings

One of the first pillars of technical analysis centers on that age-old saying of ‘the trend is your friend.’

And the reason for this goes right back to one of those very first things we touched on at the beginning of this article: The future really is unpredictable.

But trends take place for reasons, right? Maybe it was a QE announcement, or a Debt Crisis - whatever the reason, trends exist much like the tide of the ocean exists.

And just like swimmers in the ocean, traders are often best served by going with the flow.

Because, if we look at trading as pessimistically as we can, and we assume that any individual trade is akin to flipping a coin, then we have a 50/50 chance of price moving up or down, right?

Well, if that bias continues, and further - if we are trading in the direction of that bias, it stands to reason that we can begin moving our chances or probabilities of success slightly better than a 50/50 split.

Perhaps it’s small, perhaps as small as 51/49 in our favor, or 52/48 - but the logic is the same.

If what has happened continues happening, I may stand a better-than-fair chance at success.

If we add in strong money management, well - now we have an entire strategy!

Traders can read and gauge trends using solely price action. We expand on this topic in our Introduction to Price Action; but we can simply look to the chart to point out the trend.

Up-trends will often be highlighted with higher-highs, and lower-lows

Image taken from Price Action, an Introduction

Image taken from Price Action, an Introduction

Meanwhile, down-trends will see lower-lows, and lower-highs

Image taken from Price Action, an Introduction

Image taken from Price Action, an Introduction

And this, in-and-of-itself, is very powerful... but the big question you need to ask yourself is whether it is enough to just simply ‘buy’ when prices have been moving higher, or to ‘sell’ when prices have been moving lower?

The answer is a definitive ‘no.’ And the reason is because, once again, we want to try to get the best possible chances of success in the market given the information available to us, and for that we can move on to the next method.

Method 3: Use Price Action to Highlight Valuable Support and Resistance

The second primary aspect of technical analysis is Support and Resistance, and this is another message that the study of prices can bring to us.

Price Swings can identify support and resistance in the market

Image taken from Price Action Swings

Image taken from Price Action Swings

Reading ‘swings’ in the market is an easy way to begin doing this. A swing can, quite simply, be classified as an inflection point in the market. We discussed this topic in the article Price Action Swings, and have added an illustration below to highlight this point.

The swing in the market is the point at which demand outstripped supply (in the case of a swing low setting support), or supply ran over demand (creating a swing high of resistance before prices moved lower).

Traders can use these progressively higher swing-highs, and higher swing-lows to define an up-trend. Each of these swing-highs offering a point of support with which traders may be able to look to buy into the up-trend ‘cheaply.’

Higher swing-lows define support in an up-trend

Image taken from Price Action Swings

Image taken from Price Action Swings

They can also use progressively lower-lows, and lower-highs to denominate a down-trend. And, of course, each of these lower ‘swing-highs’ become levels of resistance that traders can use.

Lower swing-highs define resistance in a down-trend

Image taken from Price Action Swings

Image taken from Price Action Swings

We can even rope in some additional Support and Resistance studies in an attempt to find really important levels. Psychological levels, for instance, can be a great way of pointing out swings that might have a little more importance in the market place. Fibonacci can be another fantastic addition to Price Action to point out levels that other traders may be watching for.

After traders can identify swings with support and resistance inflections, traders can then begin looking to buy up-trends cheaply, at or near support; while traders can look to sell expensively when prices are at or near resistance. Which brings us to the exact entry of the trade…

Method 4: Use Price Action Formations to Trigger into Positions

After the trend has been identified, and after traders have found support and resistance via swings displayed in the marketplace, traders can begin looking for formations to decide when, and how to enter into positions.

There are quite a few of these out there, and we’ve talked about numerous such formations over the past few years. Most recently, we highlighted five of the most common bearish reversal patterns in the article, Trading Bearish Reversals.

A Bearish Engulfing Pattern before a massive move lower

Image taken from Trading Bearish Reversals

Image taken from Trading Bearish Reversals

We also published this piece specifically on the hammer and inverted hammer formations.

Image taken from The Hammer Trigger for Bullish Reversals

Image taken from The Hammer Trigger for Bullish Reversals

And, a favorite of price action traders, the pin bar can offer some excellent entry opportunities.

To learn more:

I know that when I was learning price action, much of it, at least initially, felt very esoteric. So, in our constant effort to provide the best possible education for our traders, we offer numerous price-action based webinars every single week.

I do a webinar on DailyFX each week. During this webinar, I’ll look at various markets to show how traders can integrate this type of knowledge in a dynamic environment, and further - how to strategize with and around it.

-- Written by James Stanley

James is available on Twitter @JStanleyFX

To join James Stanley’s distribution list, please click here.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

DISCLOSURES

DISCLOSURES

No comments:

Post a Comment