3 Trading Tips for RSI

Aug 28, 2014 12:00 am +06:00

Talking Points

- In a Downtrend, RSI Can Remain Oversold

- Use the Centerline to Determine Market Direction

- Settings Can be Adjusted for More or Less Oscillation

Let’s get started!

(Created using FXCM’s Marketscope 2.0 charts)

(Created using FXCM’s Marketscope 2.0 charts)

Think Beyond the Crossovers

When traders first learn about RSI and other oscillators, they tend to gravitate to overbought and oversold values. While these are intuitive points to enter in the market on retracements, this can be counterproductive in strong trending environments. RSI is considered a momentum oscillator, and this means extended trends can keep RSI overbought or oversold for long periods of time.

Above we can see a prime example using RSI on a GBPUSD 8Hour chart. Even though RSI dropped below a reading of 30, on July 27th, price continued to decline as much as 402 pips through today’s trading. This could have spelled trouble for traders looking to buy on a RSI crossover from overbought values. Instead consider the alternative and look to sell the market when RSI is oversold in a downtrend, and buying when RSI is overbought in an uptrend.

Learn Forex – GBPUSD 8Hour

(Created using FXCM’s Marketscope 2.0 charts)

(Created using FXCM’s Marketscope 2.0 charts)

Watch the Center Line

All oscillators have a center line and more often than not, they become a forgotten backdrop compared to the indicator itself. RSI is no different with a center line found in the middle of the range at a reading of 50. Technical traders use the centerline to show shifts in the trend. If RSI is above 50, momentum is considered up and traders can look for opportunities to buy the market. A drop below 50 would indicate the development of a new bearish market trend.

In the graph above we can again see our GBPUSD example using an 8HR chart. Notice how when price pushed upward, RSI remained above 50. Even at times, the center line acted as indicator support as RSI failed to break below this value on June 24 th prior to the creation of a higher high. However, as momentum shifted, RSI dropped below 50 indicating a bearish reversal. Knowing this, traders could conclude any existing long positions, or look for order entries with prices new direction.

Check Your Parameters

Check Your Parameters

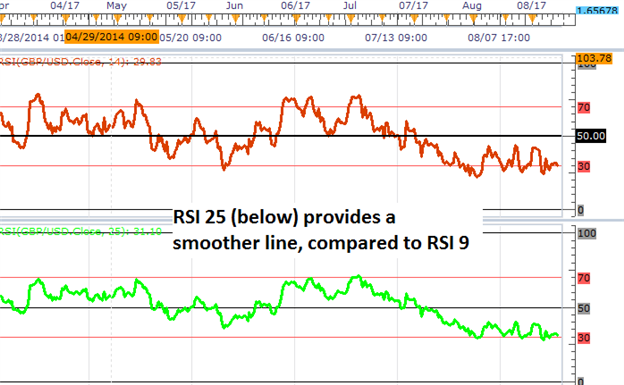

RSI like many other oscillators is defaulted to a 14 period setting. This means the indicator looks back 14 bars on whatever graph you may be viewing, to create its reading. Even though 14 is the defaulted setting that may not make it the best setting for your trading. Normally short term traders use a smaller period, such as a 7 period RSI, to create more indicator oscillator. While longer term traders may opt for a higher period, such as a 25 period RSI) for a mother indicator line.

In our final comparison, you can see a 9 period RSI line side by side with a 25 period RSI line. While there may not seem like much difference at first glance, pay close attention to the centerline along with crossovers of the 70 and 30 values. The RSI 9 at the top of the graph has considerably more oscillation compared to its RSI 25 counterpart.

Interested in learning more about Forex trading and strategy development? Signup for a series of free “Advanced Trading” guides, to help you get up to speed on a variety of trading topics.

Register here to continue your Forex learning now!

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@DailyFX.com . Follow me on Twitter at @WEnglandFX.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

DISCLOSURES

DISCLOSURES

No comments:

Post a Comment